Investing in the Future: Understanding ProShares UltraPro QQQ (TQQQ)

As technology continues to shape our world, it's no surprise that investing in the future has become a top priority for many. One way to do this is by leveraging exchange-traded funds (ETFs) that track the performance of leading tech companies. In this article, we'll delve into the details of ProShares UltraPro QQQ (TQQQ), exploring its stock price, news, quote, and history.

What is ProShares UltraPro QQQ (TQQQ)?

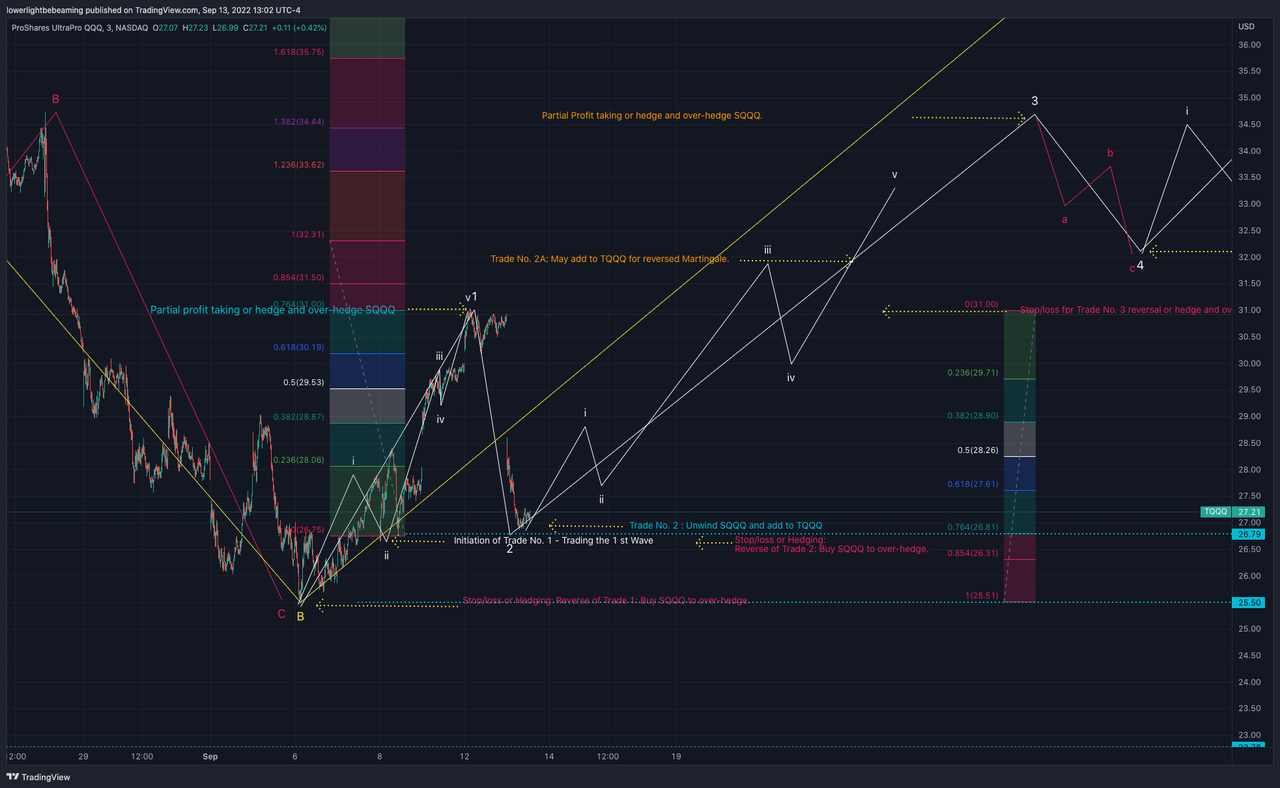

ProShares UltraPro QQQ (TQQQ) is an ETF that tracks the Nasdaq-100 Index. The fund is designed to provide triple the daily return of the underlying index, making it a popular choice for investors seeking exposure to the tech sector.

Stock Price and Quote

As with any publicly traded security, TQQQ's stock price can fluctuate in response to various market and economic factors. As of [current date], the ETF's price is $[insert current price]. For real-time quotes and up-to-date pricing information, investors can check financial websites such as Yahoo Finance or Google Finance.

News and Developments

TQQQ is a dynamic fund that reflects the changing landscape of the tech industry. Recent news and developments include:

Big Tech Earnings: Quarterly earnings reports from leading tech companies like Apple (AAPL), Amazon (AMZN), and Facebook (FB) can impact TQQQ's performance.

Regulatory Updates: Changes to data privacy laws, antitrust regulations, or tax policies can affect the ETF's holdings.

Market Volatility: As with any stock or ETF, market volatility can cause significant fluctuations in TQQQ's price.

History and Performance

TQQQ was launched in 2011 by ProShares, a leading provider of ETFs. Since its inception, the fund has demonstrated strong performance, particularly during periods of growth in the tech sector. As of [current date], TQQQ has:

Returned [insert percentage] over the past year

Returned [insert percentage] since its inception

Investing in TQQQ

For investors seeking exposure to the tech sector, TQQQ can be a valuable addition to their portfolio. Here are some key points to consider:

Diversification: By investing in TQQQ, you're gaining exposure to a diversified basket of Nasdaq-100 Index constituents.

Leverage: The ETF's triple-leveraged strategy allows investors to amplify their returns (both positive and negative).

Convenience: Trading TQQQ on major exchanges like the NASDAQ or NYSE Arca offers flexibility and ease.

ProShares UltraPro QQQ (TQQQ) is a powerful tool for investors looking to tap into the growth potential of the tech sector. By understanding its stock price, news, quote, and history, you can make informed investment decisions and potentially benefit from this dynamic ETF. Whether you're a seasoned investor or just starting out, TQQQ offers an attractive way to invest in the future.

Additional Resources

For more information on ProShares UltraPro QQQ (TQQQ) or other ETFs, please visit:

[ProShares website](https://www.proshares.com/)

[Investing apps like Robinhood or Fidelity](https://www.robinhood.com/)